Winnow's detailed Early Warning Alert Capability (EWAC) identifies issues early across the account and business life cycle to enable quick action by management.

Key alerts include reduction in new bookings, less activation, drop in line or loan size, increase in attrition, reduced income streams from interest, fees etc.

Winnow's detailed Early Warning Alert Capability (EWAC) identifies issues early across the account and business life cycle to enable quick action by management.

Key alerts include reduction in new bookings, less activation, drop in line or loan size, increase in attrition, reduced income streams from interest, fees etc.

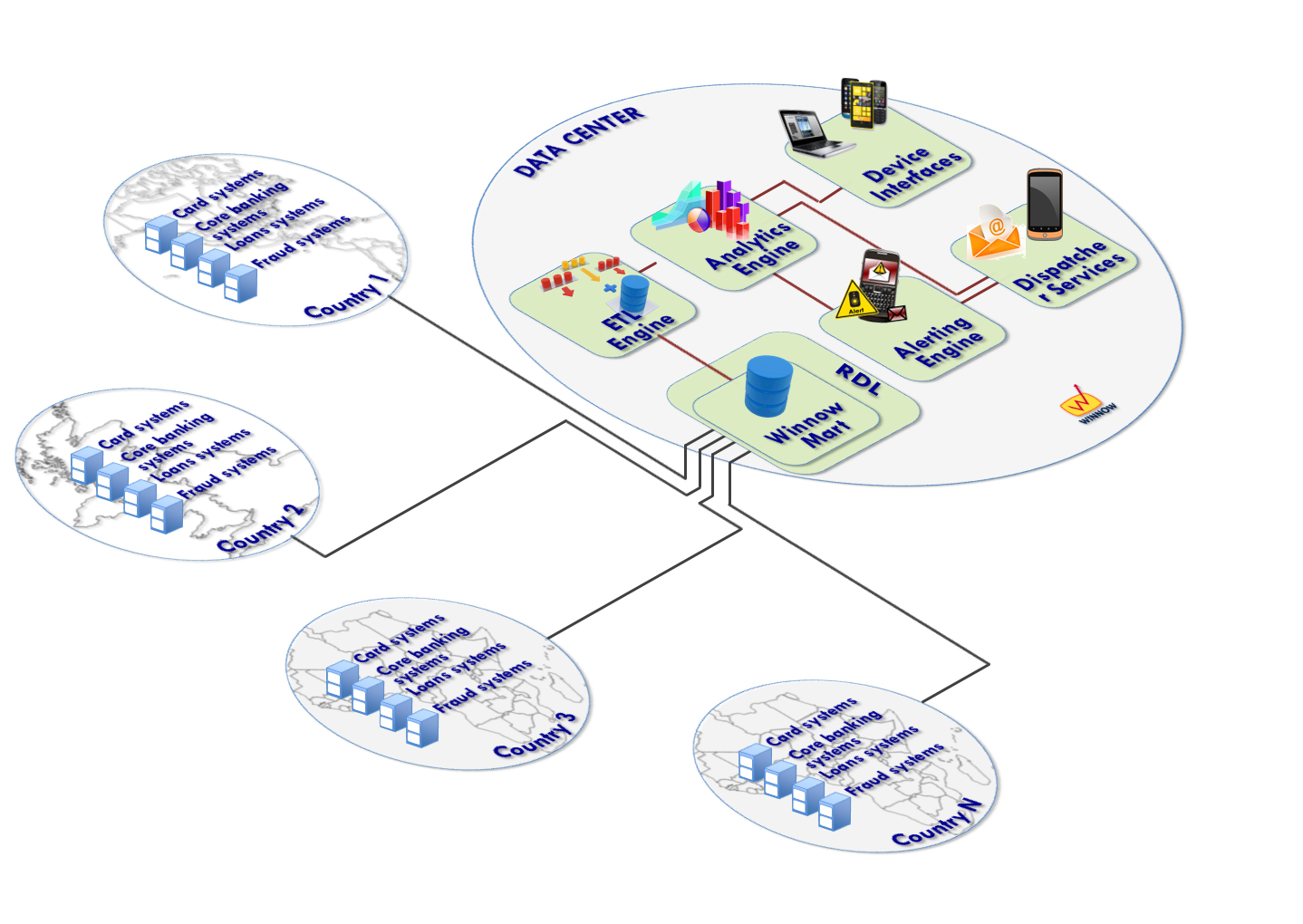

Winnow Environment

Standard Reporting

Current Environment

Winnow Environment

Adhoc Reporting

Current Environment

Winnow Environment

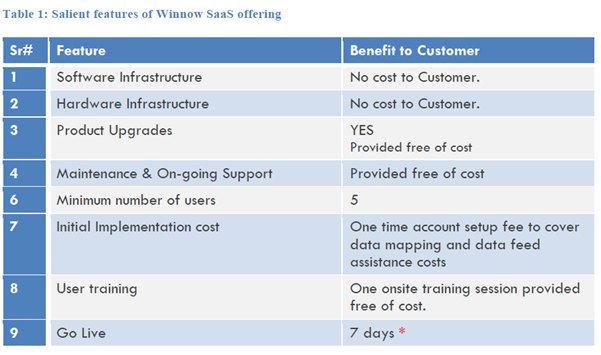

Axslogic offers Winnow on a SaaS model that provides Winnow customers significant benefits at very limited upfront costs. In the SaaS model, Axslogic will host and manage Winnow at a secure and reliable External Data Center.

Customers access Winnow SaaS by purchasing Access Logins for the number of users required. There are no restrictions on the number of accounts, barring a minimum number of logins that must be purchased initially.

Download and go

Download Alerts and reports as Excel, PPT or PDF.

Create Briefing books on the fly before any meetings or discussion.